#

Country compliance

#

Introduction

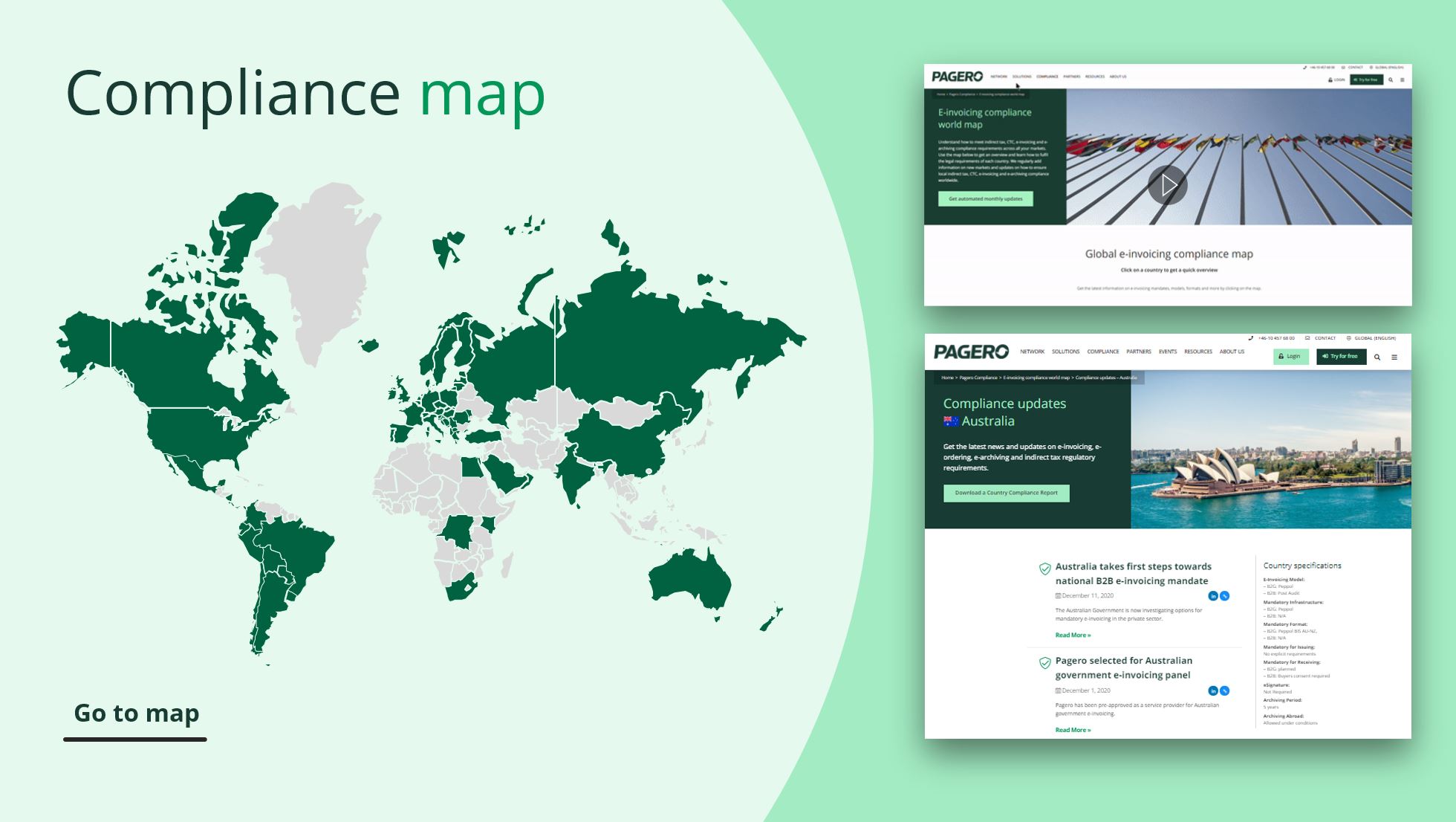

This section includes information about country compliance, requirements and other information concerning invoicing in select countries.

We can help you fulfil local e-document and tax requirements everywhere you do business and we can help you understand how to meet indirect tax, CTC, e-invoicing and e-archiving compliance requirements across all your markets.

We regularly add information on new markets and updates on how to ensure local indirect tax, CTC, e-invoicing and e-archiving compliance worldwide.

Please use the sidebar on the left to navigate between the various countries.

#

Compliance monitor

Compliance Monitor is our newsletter dedicated for e-document compliance and consists, primarily, of compliance updates and, secondarily, of additional relevant information from external sources.

It is being sent out to subscribers at the beginning of each month and contains the updates from the previous month.

You can subscribe to our monitor below and always be aware of the latest updates in the compliance landscape.

#

Compliance alerts

Compliance alerts are real-time notifications available exclusively for existing end-users.

Posted in our support center under "Format & Compliance", they inform subscribers about factual final and urgent changes within a certain jurisdiction that might require immediate actions from the end-user side.

To receive the alerts, please “follow” the countries you are interested in (it is not possible to automatically follow all countries or a region) via the link below.

In this case, the notifications will be sent via e-mail once they have been posted in the support center.

#

Content recommendations

Pagero has analyzed and compiled a more concrete technical overview of all specific content for selected countries. Pagero updates these recommended content documents continuously. To access the recommended content and get the up to date version, contact us at Pagero.